Get the free st 105

Show details

Indiana Department of Revenuers ST105

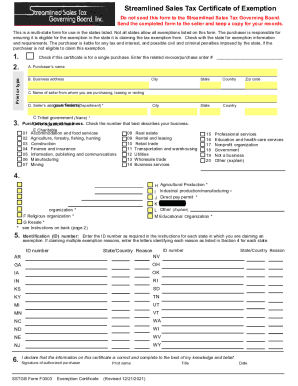

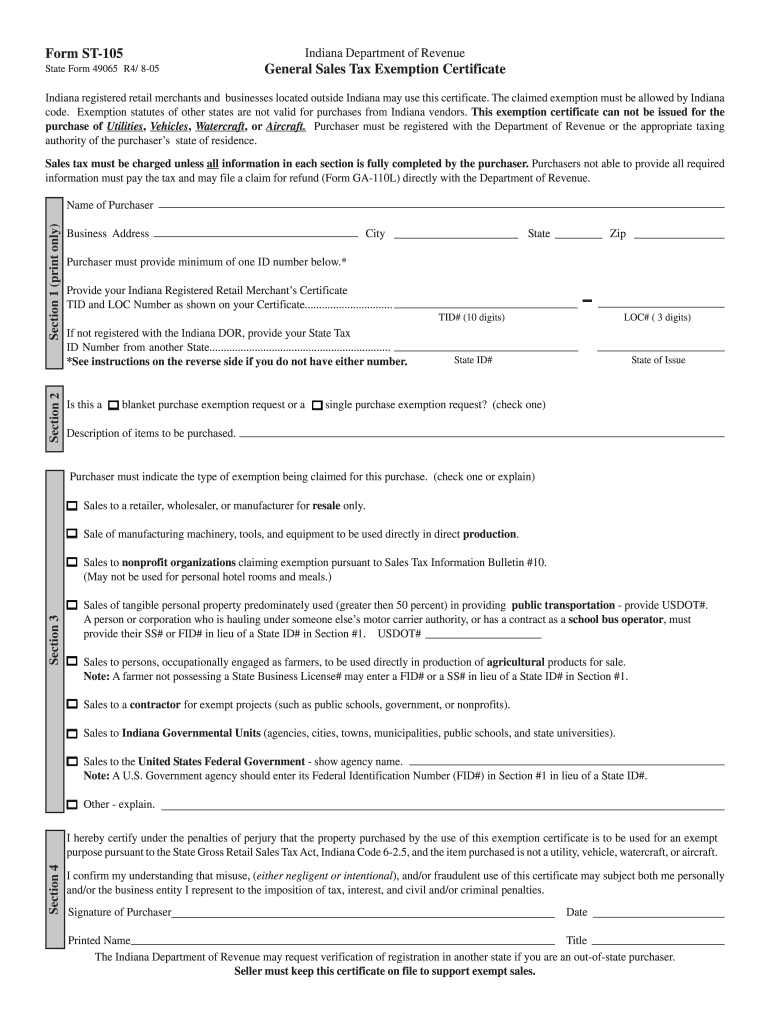

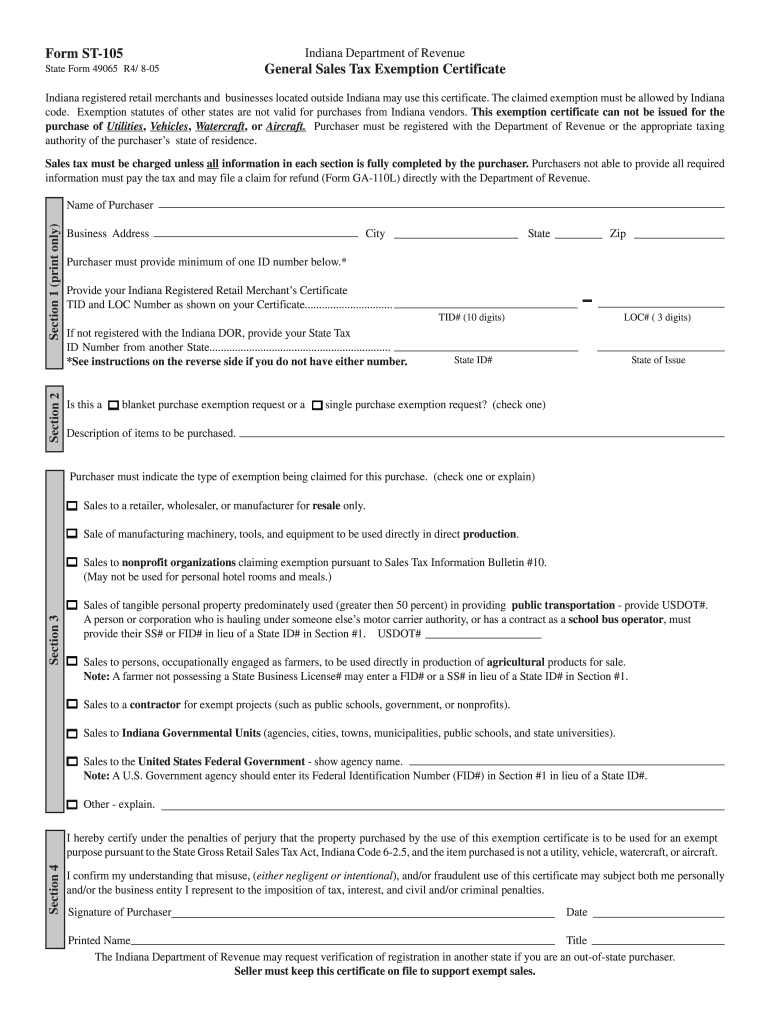

State Form 49065 R4/ 805General Sales Tax Exemption Certificate Indiana registered retail merchants and businesses located outside Indiana may use this certificate.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign st105 form

Edit your tax exempt form indiana form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indiana tax exempt form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit st 105 indiana online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit st105 indiana form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out st105 form

How to fill out ST 105?

01

Gather all necessary information: Before starting to fill out ST 105, ensure that you have all the required details readily available. This may include your personal information, such as your name, address, and contact information, as well as any relevant financial or tax-related information.

02

Read the instructions: Carefully go through the instructions provided with the ST 105 form. Understanding the guidelines and requirements will help you accurately complete the form.

03

Begin with personal information: Start by filling out the personal information section of the ST 105 form. This typically includes your name, social security number, address, and contact details. Make sure that all the information is accurate and updated.

04

Provide the relevant tax details: The ST 105 form may require you to provide specific tax-related information, such as your total income, deductions, and credits. Ensure that you have the necessary documentation, such as W-2 forms or 1099s, to accurately report your financial information.

05

Review and double-check: Once you have completed filling out the form, take the time to carefully review each section. Make sure that all the information provided is accurate and legible. Double-check for any missing or incomplete sections.

06

Sign and date the form: After confirming the accuracy of your information, sign and date the ST 105 form. This serves as your affirmation that the details provided are true and complete to the best of your knowledge.

Who needs ST 105?

01

Individuals filing state taxes: ST 105 is required by individuals who need to file their state income taxes. It is important to consult with local tax authorities or refer to the specific requirements of your state to determine if ST 105 is applicable in your case.

02

Taxpayers with state tax obligations: Individuals who have state tax obligations, such as owing state income tax or qualifying for state tax credits or deductions, may need to fill out and submit ST 105.

03

Residents or non-residents with state income: Whether you are a resident or non-resident earning income within a specific state, you may be required to complete ST 105 if your state requires income tax reporting.

Remember to consult with a tax professional or refer to the guidelines provided by your state's tax authority for specific details on whether you need to fill out ST 105 and how to accurately complete the form based on your individual circumstances.

Fill

indiana sales tax exemption form

: Try Risk Free

What is form st 105 indiana?

Sales to a contractor for exempt projects (such as public schools, government, or nonprofits). ... Printed Name Title The Indiana Department of Revenue may request verification of registration in another state if you are an out-of-state purchaser. Seller must keep this certificate on file to support exempt sales.

People Also Ask about form st 105

Does Indiana have a sales tax exemption certificate?

In order to claim an exemption from sales tax on purchases in IN, a completed Indiana General Sales Tax Exemption Certificate (ST-105), as attached below, must be presented to the vendor at the time of purchase. Please be sure to fill in the description of items to be purchased in Section 2 before signing in Section 4.

What qualifies for sales tax exemption in Indiana?

While the Indiana sales tax of 7% applies to most transactions, there are certain items that may be exempt from taxation. This page discusses various sales tax exemptions in Indiana.Other tax-exempt items in Indiana. CategoryExemption StatusFood and MealsMachineryEXEMPTRaw MaterialsEXEMPTUtilities & FuelEXEMPT19 more rows

How long is a sales tax exemption certificate good for in Indiana?

Tax exemption certificates last for one year in Alabama and Indiana. Certificates last for five years in at least 9 states: Florida, Illinois, Kansas, Kentucky, Maryland, Nevada, Pennsylvania, South Dakota, and Virginia.

What is a ST-105 form Indiana?

Indiana Form ST-105, General Sales Tax Exemption Certificate.

How to get a sales tax exemption certificate in North Carolina?

North Carolina does not require registration with the state for a resale certificate. How can you get a resale certificate in North Carolina? To get a resale certificate in North Carolina, you may fill out the Streamlined Sales and Use Tax Agreement Certificate of Exemption Form (Form E-595E).

What is the Indiana farm tax-exempt form?

Form ST-105 Indiana general sales tax exemption certificate allows property to be purchased exempt from tax if the property fits under one of the agricultural exemptions provided by Indiana law.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit indiana st 105 from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your st 105 form into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an electronic signature for the st 105 form indiana in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your form st 105 indiana fill in in seconds.

How do I complete form st 105 indiana on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your indiana form st 105 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is st 105?

ST-105 is a certificate used in the United States to claim exemption from sales tax for certain purchases.

Who is required to file st 105?

Businesses or individuals who make tax-exempt purchases, such as resale items or goods for exempt organizations, may be required to file ST-105.

How to fill out st 105?

To fill out ST-105, you typically need to provide your name, address, description of the property being purchased, and the reason for the claim of exemption.

What is the purpose of st 105?

The purpose of ST-105 is to provide a standardized way for purchasers to claim a sales tax exemption for qualifying purchases.

What information must be reported on st 105?

ST-105 requires information such as the purchaser's details, seller's information, description of the items purchased, and a declaration of the reason for tax exemption.

Fill out your st 105 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indiana st105 is not the form you're looking for?Search for another form here.

Keywords relevant to in st 105

Related to st 105 fillable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.