Get the free st 105 form

Show details

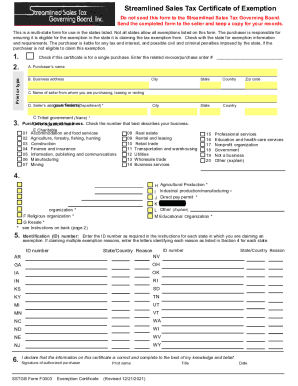

Indiana Department of Revenuers ST105

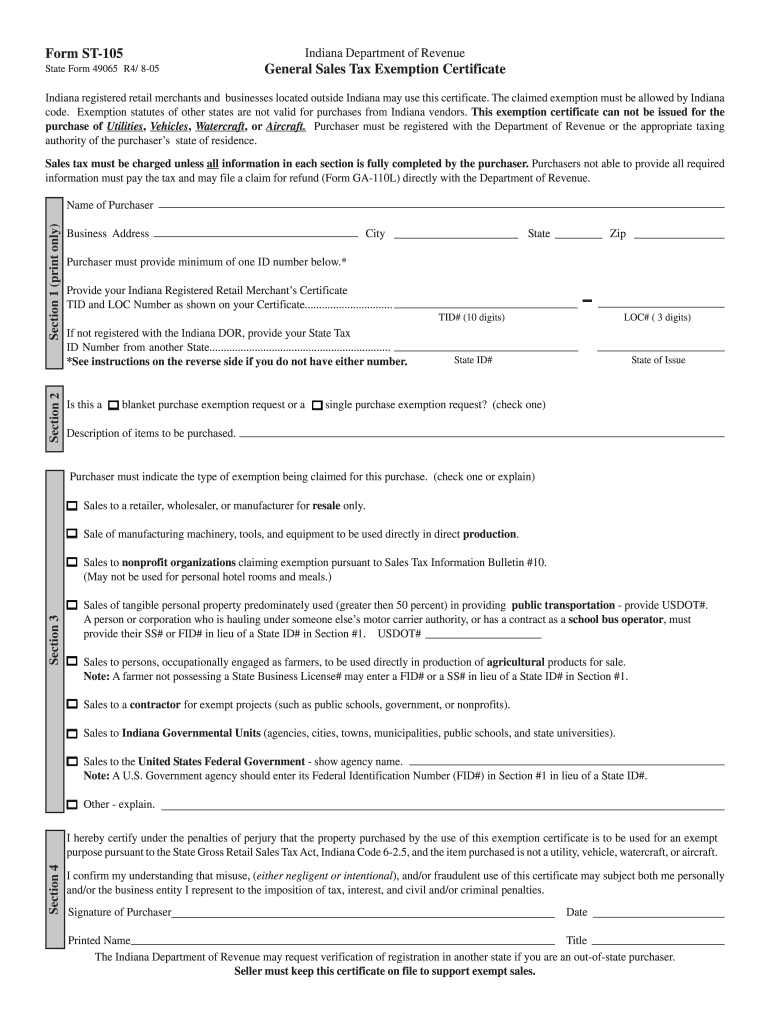

State Form 49065 R4/ 805General Sales Tax Exemption Certificate Indiana registered retail merchants and businesses located outside Indiana may use this certificate.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your st 105 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st 105 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit st 105 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit st105 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out st 105 form

How to fill out ST 105?

01

Gather all necessary information: Before starting to fill out ST 105, ensure that you have all the required details readily available. This may include your personal information, such as your name, address, and contact information, as well as any relevant financial or tax-related information.

02

Read the instructions: Carefully go through the instructions provided with the ST 105 form. Understanding the guidelines and requirements will help you accurately complete the form.

03

Begin with personal information: Start by filling out the personal information section of the ST 105 form. This typically includes your name, social security number, address, and contact details. Make sure that all the information is accurate and updated.

04

Provide the relevant tax details: The ST 105 form may require you to provide specific tax-related information, such as your total income, deductions, and credits. Ensure that you have the necessary documentation, such as W-2 forms or 1099s, to accurately report your financial information.

05

Review and double-check: Once you have completed filling out the form, take the time to carefully review each section. Make sure that all the information provided is accurate and legible. Double-check for any missing or incomplete sections.

06

Sign and date the form: After confirming the accuracy of your information, sign and date the ST 105 form. This serves as your affirmation that the details provided are true and complete to the best of your knowledge.

Who needs ST 105?

01

Individuals filing state taxes: ST 105 is required by individuals who need to file their state income taxes. It is important to consult with local tax authorities or refer to the specific requirements of your state to determine if ST 105 is applicable in your case.

02

Taxpayers with state tax obligations: Individuals who have state tax obligations, such as owing state income tax or qualifying for state tax credits or deductions, may need to fill out and submit ST 105.

03

Residents or non-residents with state income: Whether you are a resident or non-resident earning income within a specific state, you may be required to complete ST 105 if your state requires income tax reporting.

Remember to consult with a tax professional or refer to the guidelines provided by your state's tax authority for specific details on whether you need to fill out ST 105 and how to accurately complete the form based on your individual circumstances.

Fill st 105 indiana : Try Risk Free

What is form st 105 indiana?

Sales to a contractor for exempt projects (such as public schools, government, or nonprofits). ... Printed Name Title The Indiana Department of Revenue may request verification of registration in another state if you are an out-of-state purchaser. Seller must keep this certificate on file to support exempt sales.

People Also Ask about st 105

Does Indiana have a sales tax exemption certificate?

What qualifies for sales tax exemption in Indiana?

How long is a sales tax exemption certificate good for in Indiana?

What is a ST-105 form Indiana?

How to get a sales tax exemption certificate in North Carolina?

What is the Indiana farm tax-exempt form?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of st 105?

St 105 is a course offered at the University of Delaware, designed to introduce students to the fundamentals of mathematics. The course covers topics such as basic algebra, equations, inequalities, polynomials, functions, graphing, and trigonometry. The course is designed to help students develop a basic understanding of mathematics that can be applied to everyday situations and to further study in mathematics.

When is the deadline to file st 105 in 2023?

The deadline to file Form ST-105, Sales and Use Tax Return, for 2023 has not yet been determined. The deadline generally falls on the last day of the month following the month the period being reported ended.

Who is required to file st 105?

The ST-105 form is typically required to be filed by businesses or individuals who make sales and/or purchases in the state of New Jersey and are registered to collect and remit sales tax.

How to fill out st 105?

To properly fill out the ST-105 form, which is a certificate of exemption for sales tax in certain states, follow these steps:

1. Obtain the ST-105 form: Visit the tax department website of the state in which you need the exemption, or contact the department directly to request the form.

2. Provide your business information: Fill in your business name, address, phone number, and federal employer identification number (FEIN) in the designated sections of the form.

3. Select the applicable exemption reason: Check the box that corresponds to the reason for the exemption. Common reasons include resale of goods, manufacturing or processing, non-profit organization, or governmental entity. Read the instructions carefully to ensure you select the correct reason.

4. Provide seller's information: Enter the complete name and address of the seller from whom you will purchase goods or services that qualify for the exemption.

5. Specify the type of goods or services: Describe the items or services for which the exemption applies. Be specific and provide sufficient details to avoid any confusion.

6. Sign and date the form: Ensure that the form is signed and dated by an authorized representative of your business.

7. Submit the form: Depending on the state, you may need to submit the form directly to the seller, state tax department, or both. Check the instructions provided on the form or contact the tax department for proper submission guidelines.

Always consult the specific instructions provided with the ST-105 form and double-check that you have filled out all the necessary details accurately. It is also recommended to keep a copy of the completed form for your records.

What information must be reported on st 105?

The ST-105 form, also known as the Certificate of Exemption, is used in the United States for the purpose of indicating the specific reasons for sales tax exemption for purchases made by a tax-exempt entity. The information that must be reported on the ST-105 form may vary depending on the state, but typically includes the following:

1. Purchaser Information: The name, address, and tax identification number of the tax-exempt organization or individual making the purchase.

2. Exemption Basis: The specific reason for the exemption, such as being a government entity, nonprofit organization, or qualified religious institution.

3. Nature of Business: A description of the purchaser's business or organization.

4. Signature and Date: The form should be signed and dated by an authorized representative of the tax-exempt organization.

It is important to note that the requirements for the ST-105 form may differ between states, so it is always recommended to refer to the specific state's tax authority website or consult with a tax professional for accurate and up-to-date information.

How can I edit st 105 from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your st105 form into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an electronic signature for the form st 105 in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your tax exempt form indiana in seconds.

How do I complete st105 form on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your st 105 form by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your st 105 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form St 105 is not the form you're looking for?Search for another form here.

Keywords relevant to indiana st 105 form

Related to st 105 form indiana

If you believe that this page should be taken down, please follow our DMCA take down process

here

.